Table of Contents >> Show >> Hide

- The Ben Carlson Point: A Flat Year Can Feel Like a Roller Coaster

- Why Backtests Feel Easier Than Real Life

- Regulators Basically Yell “THIS IS HYPOTHETICAL” for a Reason

- The Biggest Reasons Backtests Lie (Without Intending To)

- The Missing Ingredients: Costs, Taxes, and Other Reality Gremlins

- Markets Change, and Backtests Don’t Get a Memo

- So What Are Backtests Actually Good For?

- A Practical “Reality Filter” Checklist for Any Backtest

- How to Make Backtests More “Real Life” Without Pretending You Can Predict the Future

- Conclusion: Backtests Are the Trailer, Real Life Is the Movie

- Bonus: Real-World Experiences Backtests Don’t Capture (About )

Backtests are the market’s highlight reel. They show you the beautiful step-back three, the buzzer-beater, the perfectly timed “buy the dip,” and none of the missed shots, shin splints, or moments you rage-quit because your broker app froze at the worst possible time.

That’s not an argument against backtesting. Backtests are usefulsometimes incredibly useful. They can help you understand how an idea might behave across history, what kind of drawdowns are normal, and whether a strategy has any chance of surviving contact with reality. But backtests also have a superpower that can turn into a supervillain: they make messy things look clean.

Real markets are lived forwardday by day, headline by headline, emotion by emotion. Backtests are viewed backwardsmooth, condensed, and completely indifferent to your blood pressure. If you’ve ever looked at a strategy’s historical equity curve and thought, “That seems easy,” congratulations: you’ve just discovered the main problem.

The Ben Carlson Point: A Flat Year Can Feel Like a Roller Coaster

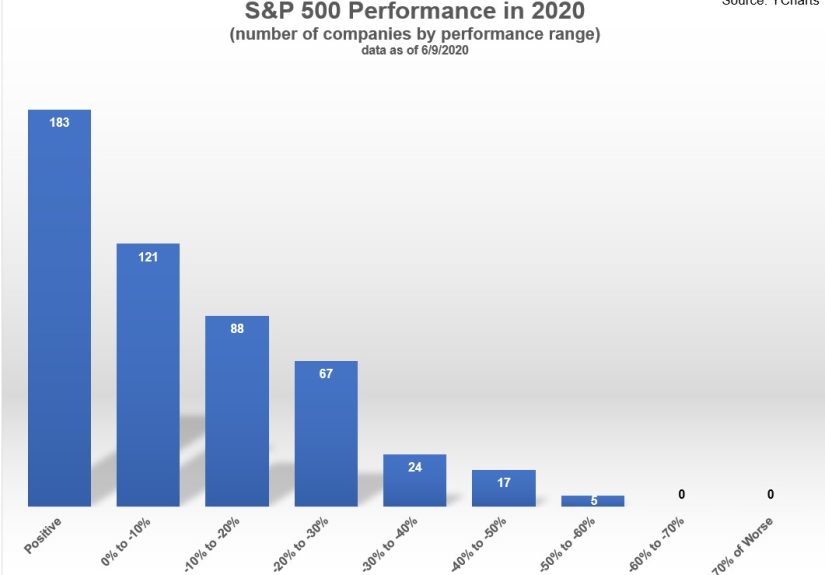

A Wealth of Common Sense (Ben Carlson) made this idea painfully clear using 2020 as the exhibit. In early 2020, the dispersion inside the S&P 500 was wild: by around late March, there were loads of individual stocks down 40%, 50%, and even 70%+ in a matter of weeks. A few months later, the distribution looked completely differentmany more stocks were positive, fewer were down huge, and the overall market was roughly flat year-to-date around early June.

Here’s the punchline: if you only looked at the headline return of “the market,” you might conclude it was a relatively boring year. But living through it in real time felt like the financial equivalent of riding a shopping cart down a hill while someone reads breaking news into a megaphone.

That gapbetween what the chart eventually shows and what the moment feels likeis where many strategies “work” in theory but fail in practice. Not because the math is wrong, but because the human (and the real-world plumbing) isn’t included in the model.

Why Backtests Feel Easier Than Real Life

1) Backtests delete the path (and the pain) between points

A backtest doesn’t make you sit through the week when your strategy is down, your group chat is up, and your brain starts writing fan fiction about how you’ll “just pause the system until things calm down.” Backtests compress time. Your stomach does not.

2) Backtests don’t capture “decision fatigue”

In a spreadsheet, you rebalance on the last trading day of the month. In real life, you rebalance on the last trading day of the month while your internet drops, your kid needs help with homework, and a scary headline makes you question every life choice since 2018.

3) Backtests don’t include the behavioral tax

Even if a strategy is statistically sound, investors don’t always follow it. People chase what just worked, ditch what just failed, and “optimize” themselves into whiplash. A backtest assumes you’re a calm, rational robot with perfect discipline. Most of us are… spirited mammals with Wi-Fi.

Regulators Basically Yell “THIS IS HYPOTHETICAL” for a Reason

U.S. regulators and industry bodies repeatedly emphasize that backtested or hypothetical performance is not actual performance. Investor guidance notes that backtesting applies a strategy to historical conditions to show how it may have performedwhile reminding investors that backtested results are hypothetical and don’t reflect real trading. The point isn’t to ban backtests; it’s to prevent people from treating simulated results like guaranteed outcomes.

In other corners of the market, required disclosures go even harder: hypothetical results can be prepared with the benefit of hindsight, don’t involve real financial risk, and can’t fully account for liquidity constraints, slippage, and the difficulty of sticking to a program during losses. In plain English: the spreadsheet doesn’t panic, but you might.

The Biggest Reasons Backtests Lie (Without Intending To)

1) Survivorship bias: the “graveyard” problem

Many datasets overweight the winners because the losers disappeared. If your backtest uses today’s universe of surviving funds or stocks and projects it backward, you can accidentally erase bankruptcies, delistings, closures, and mergersthe very events that make real investing risky.

That’s why serious research often emphasizes survivorship-bias-free data. When you include the full historyincluding the failuresthe “easy alpha” tends to look a lot less easy.

2) Look-ahead bias: time travel disguised as research

This happens when the test uses information that wouldn’t have been known at the time of the trade. Sometimes it’s obvious (using tomorrow’s close to decide today’s trade). Sometimes it’s subtle (using financial statement data without respecting reporting lags). Either way, it can turn a mediocre idea into a “holy grail” purely through accidental cheating.

3) Data mining and p-hacking: the “I tried 10,000 knobs” issue

If you test enough variationsdifferent indicators, thresholds, time windows, filterssomething will look amazing just by chance. This is the investing version of flipping coins until you get a streak and then calling yourself a wizard.

Research firms have written at length about data mining: backtests can be overstated when researchers run many trials and only publish the winners. In that world, impressive historical statistics can be more “selection effect” than “edge.”

4) Overfitting: when your model memorizes the past

Overfitting is what happens when a strategy becomes too tailored to the quirks of the sample period. It can look spectacular in-sample and then fall apart out-of-samplebecause it learned noise instead of signal.

Academic work on backtest overfitting shows how easy it is to produce strategies that look strong historically but are statistically fragile. The more flexibility you give a model, the more likely it is to “discover” patterns that don’t repeat.

The Missing Ingredients: Costs, Taxes, and Other Reality Gremlins

Transaction costs & slippage

Backtests often assume trades happen at clean prices with minimal friction. Real execution can be messier: spreads widen, liquidity dries up, and market impact grows when strategies scale. These “small” frictions can eat a meaningful chunk of returnsespecially for high-turnover strategies.

Implementation shortfall: the gap between paper and practice

Institutional practitioners use the concept of implementation shortfall to measure the full cost of implementing a decisionexplicit costs (commissions) plus implicit costs (market impact, delays, and missed fills). Research and practitioner commentary highlight that these frictions can meaningfully reduce live performance versus paper portfolios, especially for factor strategies and frequent rebalancing approaches.

Fees and platform realities

Backtests can ignore fund expenses, trading fees, borrow costs (for shorts), and operational constraints. Even small recurring costs compound over time. A strategy with a tiny statistical edge can become a coin flip after expenses.

Taxes (the world’s least fun surprise)

If you’re backtesting in a taxable context, ignoring taxes can make a strategy look better than it will feel. Turnover can generate short-term gains; distributions can land at inconvenient times; and tax drag can turn “great on paper” into “fine, I guess.”

Markets Change, and Backtests Don’t Get a Memo

Backtests are anchored in history. Markets are not obligated to repeat it. Regimes shift: inflation returns, rates move, correlations change, new participants crowd trades, and a once-obscure anomaly gets turned into a product with a ticker symbol and a marketing budget.

That doesn’t mean history is useless. It means you should treat a backtest like a stress story, not a prophecy. The goal is to understand how a strategy behaves across different environmentsand how it might failnot to assume the future will politely match the past.

So What Are Backtests Actually Good For?

They’re good for expectation-setting

A solid backtest can show you: typical drawdowns, streaks of underperformance, volatility patterns, and whether a strategy’s risk looks survivable. This is less about predicting returns and more about predicting your reaction to the ride.

They’re good for “first-pass” logic checks

Does the strategy have a coherent thesis? Does it rely on impossible fills? Does it collapse once you add conservative cost assumptions? Backtesting is great at exposing obvious nonsense quicklylike shining a flashlight under the bed before you commit to sleeping there.

They’re good for comparing trade-offs

Backtests can help compare strategy variants: lower turnover vs. higher turnover, monthly vs. quarterly rebalancing, tighter risk controls vs. looser. You’re not hunting for the prettiest equity curve; you’re hunting for something robust enough to survive reality.

A Practical “Reality Filter” Checklist for Any Backtest

- Data integrity: Is the dataset survivorship-bias-free? Are corporate actions handled correctly?

- No time travel: Does the test respect reporting lags and trading signals available at the time?

- Cost assumptions: Are spreads, slippage, and market impact modeled conservatively?

- Turnover sanity: Does the strategy trade so often it would realistically leak returns?

- Capacity: Would this still work if more money follows it?

- Overfitting checks: How many parameters are being optimized? Is there out-of-sample testing?

- Stress environments: How does it behave in crises, sideways markets, and regime shifts?

- Behavioral feasibility: Would a human actually stick with this through inevitable drawdowns?

- Benchmark honesty: Are you comparing to an appropriate benchmark, net of relevant costs?

- Implementation plan: Do you know exactly how you would execute and rebalance in real time?

How to Make Backtests More “Real Life” Without Pretending You Can Predict the Future

Use conservative assumptions (then make them more conservative)

If your strategy only works with perfect execution and zero costs, it doesn’t work. Bake in frictions. Assume worse fills. Add buffers. Reduce expected returns. If it still looks viable, you may be onto something.

Separate research from marketing

Backtests can educate, but they can also seduce. The prettier the chart, the more your brain wants to believe. That’s why performance-claim guidance warns about cherry-picking and unrealistic expectations. Treat the backtest as a research artifact, not a sales pitch.

Prefer robustness over perfection

Instead of searching for the single “best” parameter, look for ranges where results are reasonably stable. A strategy that performs “pretty good” across many settings is often more trustworthy than one that performs “perfect” in exactly one setting.

Think in ranges, not point estimates

The future is a distribution. Your backtest is one historical path. The best use of history is to understand variability: what’s plausible, what’s painful, and what kinds of failures are common.

Conclusion: Backtests Are the Trailer, Real Life Is the Movie

Backtests are valuablewhen you treat them like a tool, not a fortune teller. They can help you learn how an idea behaved in the past, identify risks you didn’t consider, and set expectations about volatility and drawdowns. But they also remove the hardest part of investing: living through uncertainty in real time.

That’s the core lesson behind “Backtests vs. Real Life in the Markets.” In hindsight, the first half of a chaotic year can look “easy,” even if it felt like an endurance sport at the time. The market’s final score is not the same thing as the game.

So run backtests. Love backtests. Just don’t marry the backtest. Date it. Ask it hard questions. Meet its weird friends (costs, slippage, bias, regime shifts). And then decide whether the strategy is something you could actually live withwhen the market stops being a chart and starts being your Tuesday.

Bonus: Real-World Experiences Backtests Don’t Capture (About )

Experience #1: The “I Knew the Rules… Until I Felt the Feelings” moment. A common real-life pattern goes like this: someone builds a rules-based strategysay, a simple trend-following overlay or a systematic rebalancing plan. The backtest shows long stretches of steady progress with occasional drawdowns that eventually recover. Then the strategy hits a rough patch in real time. The losses are identical (or smaller!) than what history suggested, but the emotional impact is bigger because it’s happening now. The investor starts negotiating: “Maybe I’ll reduce risk temporarily,” which becomes “Maybe I’ll pause until volatility settles,” which becomes “I’ll get back in when it looks safer.” The backtest never shows the cost of that hesitation: missed rebounds, delayed re-entry, and the slow transformation of a disciplined plan into a series of impulse decisions.

Experience #2: The “paper liquidity” problem. Backtests often assume you can trade at clean prices whenever you want. In real life, spreads widen in fast markets, price jumps happen between quotes, and liquidity can get weird exactly when everyone wants out. Investors who’ve only seen the smooth curve can be surprised by how quickly “small” execution differences add upespecially for strategies that trade frequently or rely on tight entries/exits. It’s not just that costs exist; it’s that costs are often highest when you’re most stressed.

Experience #3: The “life schedule” tax. Backtests don’t model you having a job, school, family obligations, travel days, or the fact that you’re not always available at the rebalance timestamp. Real investors miss trades. They get distracted. They postpone decisions. They say, “I’ll do it tonight,” and then tonight becomes next week. The strategy didn’t fail; the implementation drifted. That drift can subtly increase risk (holding too long, rebalancing too late) or reduce returns (missing a rule-based buy). Over time, the gap between “paper” and “practice” growsquietly, like a slow leak.

Experience #4: The “I optimized the wrong thing” lesson. People often optimize for the best historical return, the highest Sharpe ratio, or the prettiest drawdown chart. Real life tends to punish that. The strategy with the best backtest can be the most fragileoverfit to a particular era, a particular volatility regime, or a particular pattern that got arbitraged away. Many investors eventually learn to optimize for something less glamorous: robustness, simplicity, and a plan they can follow when markets are boring and when they’re scary. The real win isn’t finding a strategy that looked perfect in hindsight. It’s finding one that you can actually executeconsistentlywithout turning every market wiggle into an identity crisis.

Experience #5: The “headline gap” that changes your behavior. A backtest doesn’t play news clips next to each data point. In real markets, the numbers arrive with stories attached: recession fears, rate shocks, geopolitical events, bubbles, crashes, layoffs, and viral hot takes. Those narratives change how you interpret normal volatility. A 2% down day in a vacuum is just a 2% down day. A 2% down day with a scary story feels like the beginning of the end. That’s why the same final return can look calm in a chart and feel intense in the moment. The backtest gives you the outcome; real life gives you the experience.