Table of Contents >> Show >> Hide

- 1. The Rocket Ride of Inflation: From Pandemic to Peak

- 2. Stock Market Volatility: The Unpredictability Index

- 3. The Housing Market Rollercoaster: Interest Rates vs. Housing Prices

- 4. Cryptocurrency Wild Ride: Volatility Unleashed

- 5. Global Debt Levels: The Debt Explosion

- 6. The Energy Price Surge: A Global Crisis in the Making?

- Conclusion: A Year of Extremes and Uncertainty

- My Experiences with “The Craziest Charts”

- SEO Meta Information:

The world of finance and investing is filled with data, charts, and graphs that paint a picture of trends, patterns, and shifts in the market. However, not all charts are created equal. Some are ordinary, while others stand out for their sheer craziness, leaving us scratching our heads and questioning what’s going on in the world. This year, we’ve witnessed some of the most jaw-dropping financial charts that highlight extreme volatility, unexpected trends, and the unique dynamics of the global economy. These charts are not just pretty visuals; they tell compelling stories about the state of our financial systems. Here are the craziest charts of the year so far, as seen through the lens of common sense and a pinch of humor.

1. The Rocket Ride of Inflation: From Pandemic to Peak

2023 has been the year of inflation. The chart tracking inflation across major economies, particularly in the United States, has looked like a rocket launch. In early 2020, inflation was almost non-existent as economies shut down, and then came the flood of stimulus checks and pandemic-related supply chain issues. The line shot up dramatically, peaking in mid-2022. What followed was a turbulent ride down to more manageable levels, but it remains high compared to historical norms. The chart of inflation over the past three years is a visual testament to how quickly the global economy can shift from calm to chaos and back again.

Key Takeaways:

- The U.S. experienced its highest inflation rate in four decades.

- Supply chain disruptions and labor shortages played a pivotal role.

- The Federal Reserve’s actions in adjusting interest rates were critical to bring inflation down.

2. Stock Market Volatility: The Unpredictability Index

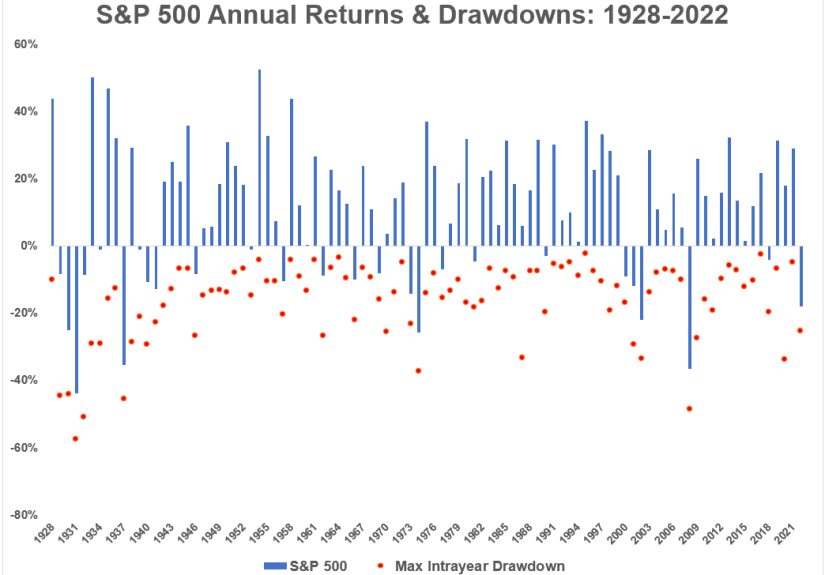

The stock market is no stranger to wild swings, but the past year has seen some of the most unpredictable movements in recent history. The chart of the S&P 500, for example, looks like a rollercoaster ride. Huge spikes followed by dramatic drops, with no clear pattern emerging, have kept investors on their toes. In particular, the sudden sell-offs in tech stocks and the brief yet sharp crashes in early 2023 have left market watchers questioning the stability of some of the largest companies in the world.

What We Can Learn:

- Even the most stable companies aren’t immune to market sentiment.

- The impact of global events such as geopolitical tensions and pandemic aftershocks cannot be underestimated.

- For investors, staying calm and diversifying portfolios is more important than ever.

3. The Housing Market Rollercoaster: Interest Rates vs. Housing Prices

Another chart that has made heads spin in 2023 is the relationship between interest rates and housing prices. As mortgage rates soared, housing prices seemed to defy gravity. Homebuyers were still willing to pay top dollar for homes, pushing prices to new highs in many parts of the U.S. The expected crash in home prices didn’t quite happen as predicted, but the chart shows a strange divergence between rising interest rates and persistently high home prices. It’s a classic case of economics not behaving the way textbooks would suggest.

Notable Insights:

- Higher mortgage rates haven’t caused the crash many expected, but affordability remains an issue for buyers.

- Limited housing supply continues to support prices, despite higher borrowing costs.

- Some markets saw rapid growth in prices, while others have stagnated or declined, showing regional variations in the housing market.

4. Cryptocurrency Wild Ride: Volatility Unleashed

The cryptocurrency market is notorious for its wild price swings, and this year has been no exception. If you look at the chart for Bitcoin or Ethereum in 2023, it looks like an unpredictable sea stormwaves up, waves down, with no real consistency. From record-breaking highs to unexpected crashes, cryptocurrency prices have been a rollercoaster ride for investors and traders alike. This volatility is driven by regulatory uncertainty, changing investor sentiment, and macroeconomic trends, making it one of the craziest charts of the year.

Key Observations:

- The rise of institutional investors and the integration of crypto into mainstream finance has led to some stabilization, but volatility remains.

- The regulatory environment is still uncertain, contributing to price swings.

- Crypto markets continue to attract both extreme optimism and pessimism from investors.

5. Global Debt Levels: The Debt Explosion

Another eye-popping chart this year has been the explosion in global debt levels. With government spending ramping up to combat the economic fallout from the pandemic, national debt skyrocketed, and the chart tracking global debt resembles a steep mountain incline. Many countries, especially advanced economies, are now burdened with debt levels that have reached historic highs. This chart highlights the long-term implications for global finance and future generations, as debt servicing continues to consume larger portions of national budgets.

What the Chart Shows:

- The global debt-to-GDP ratio has reached unsustainable levels in many countries.

- Interest rates will continue to play a critical role in managing debt levels moving forward.

- The long-term impact on growth and inflation could be profound, especially if interest rates remain high.

6. The Energy Price Surge: A Global Crisis in the Making?

Energy prices in 2023 have been a topic of global concern, with oil and natural gas prices spiking due to supply chain disruptions, geopolitical instability, and rising demand. The chart of energy prices is a jagged line that demonstrates the extreme volatility in this sector. What’s striking is the fact that even with increased production in some regions, prices have remained stubbornly high. This has led to a significant shift in how nations view energy security and the long-term sustainability of relying on fossil fuels.

What We Learned:

- Energy prices are highly susceptible to global events and natural disasters.

- Countries are doubling down on energy independence and renewables as they face the risk of future price shocks.

- Energy costs have broader implications for inflation and global economic growth.

Conclusion: A Year of Extremes and Uncertainty

The charts we’ve seen so far in 2023 are a stark reminder of how quickly the world can change. From inflationary pressures to the wild ride of the stock market and energy prices, the financial world is never boring. These charts are not just numbersthey represent human behavior, policy decisions, and global events that have shaped the economy. They reflect the uncertainty and volatility that investors, governments, and businesses must navigate in today’s world. As we look to the future, it’s clear that 2023 is a year of extremes, and we can expect even more wild charts ahead.

My Experiences with “The Craziest Charts”

As someone deeply involved in the world of investing and financial analysis, I’ve seen firsthand how these crazy charts affect decision-making. For example, during the early days of the inflation surge, many of my colleagues in the real estate industry were caught off guard by the rapid increase in home prices, which didn’t align with the traditional relationship between interest rates and housing demand. We expected a market correction, but what we saw was an environment where people were still willing to buy despite skyrocketing mortgage rates.

Similarly, the volatility in the cryptocurrency market has been both exciting and stressful. I’ve had to adjust my strategies multiple times to account for the wild price movements, sometimes finding myself on the right side of a trade and other times getting caught in the downswings. Crypto traders are used to volatility, but the magnitude of the swings this year was something else.

One of the most eye-opening experiences this year has been watching the global debt levels chart. It’s an ongoing topic of conversation among economists, as everyone wonders when the bill will come due. While many countries have successfully navigated the short-term crisis, the long-term outlook remains unclear, and the debt burden may continue to weigh heavily on future generations.

In conclusion, these charts aren’t just numbersthey’re stories in the making, and they remind us of the unpredictability and excitement that comes with navigating today’s complex financial world. I’m looking forward to seeing how the rest of the year unfolds and what other crazy charts we’ll have to analyze next!

SEO Meta Information:

sapo: In this article, we explore the craziest financial charts of 2023. From inflation surges to unpredictable stock market swings, these charts tell the story of an unpredictable year. Join us as we analyze the wildest trends and what they mean for the future.