Table of Contents >> Show >> Hide

- Why 2017 Deserved Its Own Market Awards Night

- Best Performance in a Leading Role: Global Equities

- Best Supporting Sector: Technology Steals the Spotlight

- The “Are We Sure This Is On?” Award: Volatility

- Most Underappreciated Player: The Bond Market

- The “Everybody Gets a Trophy” Award: Diversification

- The Behavioral Finance Award: Humans Being Human

- Lifetime Achievement Award: Common Sense Investing

- Post-Awards Reflections: What 2017 Still Teaches Us Today

- of Real-World Experience: Living Through the 2017 Market

If financial markets had a red carpet, 2017 would have been the year it got

rolled all the way down Wall Street and around the globe. Stocks soared,

bonds quietly did their job, volatility went into witness protection, and

investors kept asking the same question: “Is it supposed to feel this easy?”

That strange combination of strong returns and eerily calm markets makes

2017 the perfect year to hand out a tongue-in-cheek set of financial market

awards backed not by celebrity judges, but by data and common sense.

Inspired by the spirit of “A Wealth of Common Sense,” this awards recap

looks back at what really happened in 2017 across stocks, bonds, volatility,

and investor behavior. Think of it as the investing world’s yearbook with

a few jokes, a lot of numbers behind the scenes, and some practical lessons

you can still use today.

Why 2017 Deserved Its Own Market Awards Night

Before we hand out trophies, it’s worth remembering just how unusual 2017

was. U.S. stocks posted a stellar total return, global equities

outperformed, and emerging markets were off to the races. Many diversified

investors opened their year-end statements and thought, “Wow, that went

better than expected.”

The twist? Markets did all of this with shockingly low drama. The typical

pullbacks, corrections, and “I think I should check my portfolio twice a

day” feelings mostly stayed on the sidelines. For long-term investors, 2017

was a dream scenario: strong gains and very few gut-check moments.

That calm backdrop is what makes an awards format so fitting because in a

year where almost everything went right for risk assets, certain trends,

sectors, and behaviors still managed to stand out.

Best Performance in a Leading Role: Global Equities

The first big award goes to global stock markets. U.S. large-cap stocks

delivered excellent double-digit returns, but the real scene-stealers were

found abroad. Developed international stocks edged out the U.S., and

emerging markets surged even more.

If 2016 had investors asking whether global diversification was “still

worth it,” 2017 politely answered: “Yes, and you’re welcome.” A

market-cap-weighted global equity portfolio that included U.S., developed

international, and emerging markets generally beat a U.S.-only portfolio.

This is a classic example of why diversification feels boring in the moment

but rewarding over time. The years when U.S. stocks dominate tend to get all

the attention, but years like 2017 quietly do the heavy lifting for

globally-diversified portfolios.

Key takeaway for investors

Don’t confuse home-country bias with a strategy. A sensible, globally

diversified portfolio can look “just okay” for a while and then suddenly

shine when international markets finally get their turn on stage, as they

did in 2017.

Best Supporting Sector: Technology Steals the Spotlight

There’s no question that the technology sector walked away with one of the

biggest trophies in 2017. Large U.S. tech names the familiar giants in

payments, software, smartphones, and cloud computing were some of the

year’s breakout stars.

Technology’s outperformance didn’t just boost the sector itself; it

meaningfully pulled up the broader U.S. stock indices. At the same time,

most other sectors also participated. Only a couple of areas, such as energy

and telecom, finished the year in the red, while many others posted robust

double-digit gains.

In other words, 2017 wasn’t just a “tech and nothing else” story but tech

certainly got the applause and a lot of the headlines.

Key takeaway for investors

Sector leadership rotates. Technology enjoyed a huge year in 2017, but smart

investors resisted the urge to go all-in on what had just worked. A balanced

sector mix or broad index funds that own all sectors reduces the risk of

“chasing yesterday’s winner.”

The “Are We Sure This Is On?” Award: Volatility

If 2017 had a weirdest-chart prize, volatility would win by a landslide.

Equity markets climbed steadily while traditional measures of fear and

uncertainty spent much of the year at unusually low levels.

Daily moves in major stock indices were mostly small. There were remarkably

few days when markets moved more than 1% in either direction, and almost no

meaningful corrections. Headlines were loud; price swings were not.

For investors used to the 2008 crisis, the European debt scare, or even the

occasional flash crash, 2017 almost felt broken like volatility had

forgotten to show up for work. Of course, volatility never disappears; it

merely goes into hiding. But in 2017, it stayed hidden long enough for

“short vol” strategies to become trendy and for some investors to grow

overconfident.

Key takeaway for investors

Low volatility is not a reason to relax risk controls it’s often a reason

to double-check them. Calm markets encourage leverage, speculation, and

complacency. A wealth of common sense says: when everything feels too easy,

don’t assume you’ve suddenly become a genius; assume risk might be

underpriced.

Most Underappreciated Player: The Bond Market

While stocks were mugging for the cameras, bonds did what bonds usually do:

quietly help stabilize portfolios and provide income. Heading into 2017,

many investors worried that rising interest rates would spell trouble for

fixed income returns. Instead, the year turned out to be far more benign

than those fears suggested.

Long-term government bonds actually held up relatively well, and a broad

U.S. bond index delivered modest but positive returns. High-yield bonds had

another solid year, supported by low default rates and an improving global

growth backdrop.

Were bond investors doing cartwheels over those numbers? Probably not. But

in a balanced portfolio, even a low single-digit bond return can play a

critical role by dampening volatility and offering ballast against equity

risks.

Key takeaway for investors

Bonds are the supporting actors of portfolio construction, not the headliner

and that’s exactly the point. They’re there to help you stay invested

through the inevitable equity storms, not to win every performance award.

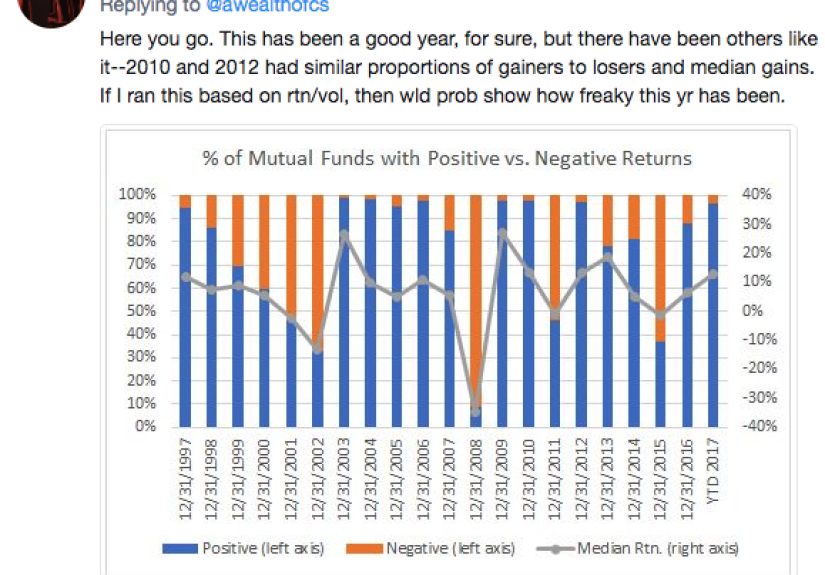

The “Everybody Gets a Trophy” Award: Diversification

One of the quirks of 2017 is that investors didn’t need a perfectly timed

trade to do well. A basic, diversified mix of U.S. stocks, international

equities, and high-quality bonds generally produced strong, positive returns.

Different risk-on assets U.S. equities, foreign stocks, emerging markets,

high yield, and even some alternative strategies all enjoyed a supportive

environment. Global growth was synchronized, central banks were cautious but

not overly restrictive, and inflation stayed relatively tame.

In that kind of backdrop, diversification really did feel like “everyone

wins.” Of course, that’s not always the case. Some years leave diversified

investors feeling like they got “average everywhere, great nowhere.” But

2017 was a reminder that owning a lot of different things can pay off

handsomely when multiple asset classes catch a positive wave.

Key takeaway for investors

Diversification is not about maximizing bragging rights in any single year;

it’s about maximizing the odds that your long-term plan actually works. In

2017, diversified investors got both: great numbers and relatively smooth

sailing.

The Behavioral Finance Award: Humans Being Human

No market awards show would be complete without spotlighting investor

behavior. Even in a year as friendly as 2017, human psychology found ways to

get itself into trouble:

-

Overconfidence: After a long stretch of steady gains,

some investors started to believe downside risk had permanently shrunk. -

Performance chasing: Flows into international and

emerging markets surged only after those areas had already outperformed. -

Short-term focus: Rather than appreciating a rare calm

year, many people spent 2017 anxiously waiting for “the next crash” and

struggled to stay invested.

Behavioral finance reminds us that the hardest part of investing is rarely

the math it’s managing emotions. Years like 2017 can be deceptively

dangerous because they tempt investors to extrapolate calm conditions

indefinitely or to lean into exotic strategies just as risks are quietly

building.

Key takeaway for investors

The most important portfolio you manage is the one in your head. A rules-

based process, realistic expectations, and an understanding of your own risk

tolerance are more valuable than any hot tip or clever trade.

Lifetime Achievement Award: Common Sense Investing

Beneath all the specific numbers and charts, 2017 rewarded a simple,

common-sense approach:

- Own a diversified mix of global stocks and high-quality bonds.

- Rebalance periodically instead of timing the market.

- Ignore most noise and focus on long-term goals.

- Respect risk even when markets feel unusually calm.

That philosophy is very much in line with the spirit of “A Wealth of Common

Sense”: investing doesn’t need to be complicated to be effective. In fact,

complexity often disguises speculation. In 2017, investors who stuck to

straightforward asset allocation, kept costs low, and avoided emotional

decisions were among the biggest winners even if they never once checked a

volatility chart.

Post-Awards Reflections: What 2017 Still Teaches Us Today

Looking back, 2017 can feel like a different universe compared with more

volatile years that followed. But its lessons are still very relevant:

-

Strong returns can coexist with low volatility. Calm

markets are not automatically “overdue” for disaster, but they also

shouldn’t lull you into ignoring risk. -

Global diversification matters. When non-U.S. markets

outperform, the payoff can be substantial for investors who resisted

home-country bias. -

Bonds remain a crucial stabilizer. Even in a rising-rate

narrative, bonds can deliver positive returns and provide important

balance. -

Behavior makes or breaks results. The best asset

allocation won’t help if you panic out or pile into fads at the wrong

time.

In that sense, the real winner of the 2017 Financial Market Awards is not a

specific index, sector, or asset class. It’s the boring, disciplined,

diversified investor who stuck with a plan throughout an unusually smooth

year and then stayed humble enough not to expect every year to behave like

2017.

of Real-World Experience: Living Through the 2017 Market

Awards and headlines are fun, but what did 2017 actually feel like for real

investors and advisors? In practice, it was a year full of subtle lessons

that only become obvious with hindsight.

First, there was the “nervous optimism” vibe. Many investors were pleasantly

surprised by their returns, yet they couldn’t fully enjoy them because they

were constantly waiting for the other shoe to drop. Every strong month

brought a new wave of articles asking, “Is the market too calm?” or “Is this

the top?” People were simultaneously making money and doubting the validity

of their own success.

Second, conversations about risk often got harder, not easier. When clients

see their portfolios go up almost every month with minimal turbulence, it’s

natural for them to wonder: “Do I really need bonds? Do I need this much

cash? Shouldn’t we be more aggressive?” In 2017, many advisors had to

explain that the purpose of defensive assets is not to win in the good

years, but to keep you invested when the good years end.

Third, 2017 was a live demonstration of how quickly narratives can flip.

Coming into the year, the storyline was all about political uncertainty,

potential trade tensions, central bank moves, and fears of a slowdown.

Coming out of the year, the story had shifted to “synchronized global

growth,” “earnings strength,” and “investor confidence.” The underlying

fundamentals evolved, but not nearly as dramatically as the headlines. For

anyone paying attention, 2017 highlighted how unreliable short-term

predictions really are.

Fourth, the year exposed the risks of confusing calm with

safe. Some investors leaned into complex volatility-selling

strategies, structured products, or leveraged funds because they seemed to

offer “easy” income in a low-volatility environment. That approach looked

brilliant until volatility eventually returned in later years and those

trades unraveled quickly. The calm of 2017 was not a permanent feature of

markets; it was a temporary condition.

Finally, 2017 was a reminder that your long-term results depend far more on

your process than on any single year. An investor with a clear plan,

sensible asset allocation, automatic contributions, and a habit of ignoring

noise could treat 2017 as one more data point along the way a very good

one, but still just one chapter in a much longer story. An investor without

that structure, however, might have used 2017 as an excuse to take on too

much risk, chase winners, or assume the future would be as smooth as the

recent past.

If there’s one experience-based lesson to carry forward from the 2017

Financial Market Awards, it’s this: enjoy the good years, but don’t

redesign your entire investment philosophy around them. Markets will not

always be so generous, volatility will not always be so quiet, and

diversification will not always feel like it’s “working” as clearly as it

did in 2017. A wealth of common sense means appreciating the good times

while building a plan sturdy enough for the bad ones, too.