Table of Contents >> Show >> Hide

- The short version: what Dallas changed, and why lenders sued

- Meet the players: CSOs, CABs, and the “Texas workaround” everyone argues about

- What the Dallas lending ordinance actually requires

- 1) Limits tied to income and collateral value (especially for title-style credit)

- 2) A “pay it down” repayment structure: four payments and meaningful reduction

- 3) Limits on refinancing/renewals

- 4) A fee cap on certain non-payday, non-title CSO-arranged credit

- 5) Counseling referrals and disclosure-style requirements

- The lawsuit posture: why “preliminary injunction” changes everything

- Why the Fifth Circuit upheld the ordinance (at least for now)

- Why this case matters beyond Dallas

- A practical, non-legal-advice checklist for Dallas compliance

- FAQ: quick answers people search for

- Bottom line: what to watch next

- Experiences related to the Fifth Circuit decision (real-world lessons from the “Dallas rules” era)

- Conclusion

Dallas didn’t just “crack down” on short-term lendingit brought a rulebook, a ruler, and (depending on your viewpoint)

either a consumer-protection cape or a business-model buzzsaw. And in a closely watched fight, the U.S. Court of Appeals

for the Fifth Circuit largely let Dallas keep the cape and the buzzsawat least for now.

On July 1, 2025, the Fifth Circuit affirmed a federal district court’s denial of a preliminary injunction

sought by TitleMax and related entities challenging Dallas’s 2021 amendments to its lending ordinance. The decision is

important not only because it keeps the ordinance in place while the case continues, but because it explains how hard it

can be to knock out a home-rule city’s consumer-lending rules on state-law preemption and

Texas constitutional “due course of law” theories.

Translation: if you were hoping for an emergency stop button, the court basically said, “Not today.” (And if you were

hoping for a win that ends the whole case forever, slow your rollthis was about a preliminary injunction, not a final

merits trial.)

The short version: what Dallas changed, and why lenders sued

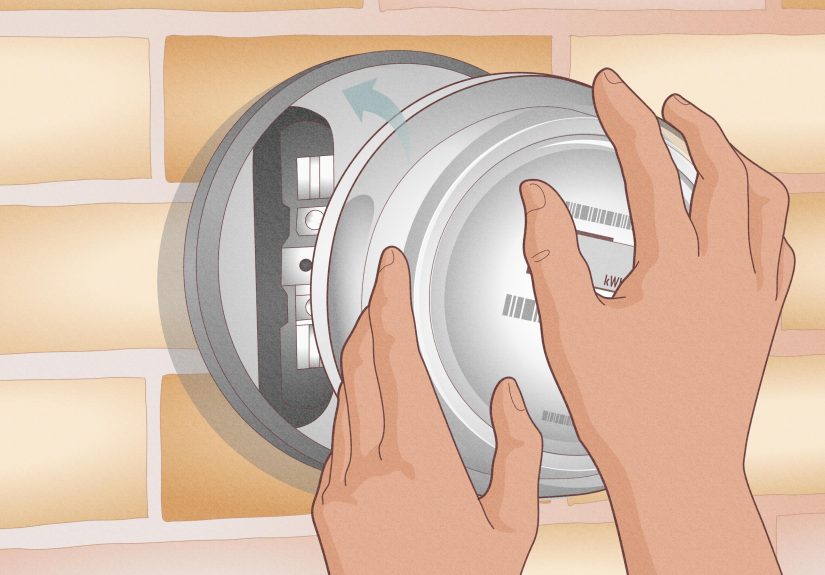

Dallas has regulated parts of the short-term lending ecosystem for years. In 2021, Dallas adopted an amending ordinance

that expanded its reach and tightened several requirements. TitleMax argued those changes devastated its Dallas business,

and asked a federal court to halt enforcement while the lawsuit played out.

TitleMax’s main arguments were:

-

Preemption: Dallas’s ordinance allegedly conflicts with Texas state law regulating credit services

organizations and credit access businesses (and therefore should be unenforceable). -

Due course of law: the ordinance allegedly violates protections under the Texas Constitution (often

discussed as Texas’s cousin of “due process,” though not identical).

The Fifth Circuit rejected TitleMax’s request for preliminary injunctive relief because TitleMax did not show a sufficient

likelihood of success on those claims under the standards governing preliminary injunctions.

Meet the players: CSOs, CABs, and the “Texas workaround” everyone argues about

Credit Services Organizations (CSOs)

In Texas, a credit services organization (CSO) is generally a business that helps a consumer obtain

credit or improve credit. In the short-term lending world, CSOs can show up as the “arranger” that connects a borrower to

a lenderoften collecting its compensation as fees.

Credit Access Businesses (CABs)

A credit access business (CAB) is defined in Texas law as a CSO that obtains (or helps obtain) certain

forms of consumer creditcommonly associated with payday-style transactions or motor vehicle title loans. CABs must be

licensed under Texas’s regulatory framework, and the licensing/oversight landscape is a big part of why cities and lenders

keep ending up in court.

Why this matters: Dallas’s ordinance doesn’t just regulate “payday lenders” as a vibe. It targets categories defined and

recognized in state law and local codethen imposes local limits on the way those businesses structure transactions.

What the Dallas lending ordinance actually requires

The ordinance is detailed, but several requirements are especially central to the disputeand to how Dallas tries to push

loans toward payoff instead of perpetual renewal.

1) Limits tied to income and collateral value (especially for title-style credit)

One provision restricts certain motor vehicle title loan amounts to the lesser of:

(a) 3% of the consumer’s gross annual income or (b) 70% of the retail value of the vehicle.

Dallas also requires documentation to establish income (think paycheck statements, W-2s, tax returns, or similar proof).

Example: If a borrower earns $40,000 per year, 3% is $1,200. If the car’s retail value is $5,000, 70% is

$3,500. Under this type of limit, the cap would be $1,200because Dallas uses the lesser figure.

2) A “pay it down” repayment structure: four payments and meaningful reduction

Dallas’s rules aim to make repayment progress unavoidable. For covered extensions of consumer credit, the ordinance can

require that the total amount owed (not just principal) be structured so it is paid in full within

four or fewer payments, and that the amount owed is reduced by at least

25% per payment.

Why this is a big deal: Many short-term products historically rely on repeated renewals or fee payments

that keep the principal from shrinking. A “25% per payment” paydown rule forces the loan to actually move toward zero.

3) Limits on refinancing/renewals

The ordinance also addresses refinancing/renewal behavior. In some structures, Dallas limits how many times a covered

transaction can be refinanced or renewed, and still requires meaningful reduction in the total amount owed when that

refinancing/renewal occurs.

Practical impact: Businesses can’t rely on “just one more rollover” as the default plan. Consumers have a

clearer runway to payoff, while lenders must price and underwrite expecting fewer repeat fees.

4) A fee cap on certain non-payday, non-title CSO-arranged credit

One of the most litigated changes: Dallas imposed a cap stating that the sum of fees or other charges owed to the credit

services organization may not exceed 0.1% per day of the outstanding balance for certain extensions of

consumer credit that are not deferred-presentment transactions (payday-style) or motor vehicle title loans.

Example math (plain-English edition): If the outstanding balance is $1,000, then 0.1% per day is $1 per

day. Over 30 days, that’s $30. Over a year, $365again, that’s a simplified illustration of the cap’s daily-fee logic,

not a promise about how any particular product is priced in the wild.

5) Counseling referrals and disclosure-style requirements

Dallas also includes consumer-facing measures such as providing a list of nonprofit agencies that offer financial

education, training programs, or cash assistance programs, along with required posters or similar disclosures for

customers who enter the facility.

The lawsuit posture: why “preliminary injunction” changes everything

A preliminary injunction is emergency relief. To get it, a plaintiff generally must show (among other factors) a

likelihood of success on the merits. That’s a high bar, especially when the requested order would

effectively freeze a city’s regulatory program.

The Fifth Circuit’s decision is not the same as a final judgment declaring the ordinance permanently valid in every

respect. But it’s still powerful: it keeps the rules operating and telegraphs how the court views the core legal theories

on the record presented at this stage.

Why the Fifth Circuit upheld the ordinance (at least for now)

Preemption: “this hurts my business” is not the same as “the city banned the whole industry”

Texas home-rule cities like Dallas have broad authority unless state law clearly takes the field away. One way a city

ordinance can fail is if it conflicts with state lawsometimes framed as a city having “no power to prohibit” an

occupation the state regulates.

TitleMax leaned hard on the idea of a “virtual prohibition”the concept that a city can’t do an end-run

around state permission by making compliance practically impossible.

The Fifth Circuit majority acknowledged that idea exists in Texas case law, but concluded TitleMax didn’t make the

necessary showing here. In the court’s view, TitleMax mainly showed that the amended ordinance made certain types of loans

unprofitable for TitleMax, not that it “effectively prohibits” all covered businesses from operating in Dallas.

The majority emphasized that a preemption finding does not automatically follow just because one company says it can’t

profitably comply while others might be able to.

Due course of law: lending is heavily regulated, and not every business model is a constitutional right

On the due-course-of-law claim, the decision reads like a reality check for anyone who thinks “I have a right to do

business the way I prefer” is a magic spell.

The court stressed the long history of usury regulation and the principle that the “right to lend money at interest” is

treated as a matter of statute and regulation rather than an inherent, untouchable liberty interest. In other words:

Texas (and the nation) has regulated interest, fees, and lending practices for a very long time. That history matters when

you argue the Constitution protects your preferred lending structure.

The dissent: a warning label attached to the majority’s reasoning

The decision wasn’t unanimous. Judge Don R. Willett dissented in part. He agreed TitleMax’s due-course-of-law claim fell

short, but he parted ways on preemptionarguing that the evidence at this stage supported a sufficient prima facie showing

that the ordinance’s fee cap functioned as a “virtual prohibition” for TitleMax’s unsecured-loans business.

The dissent’s tone is a signal flare: even if the city wins the emergency round, the factual record on profitability and

operability could still matter later, especially if plaintiffs develop stronger evidence about how the ordinance functions

across the market.

Why this case matters beyond Dallas

1) It gives a roadmap for cities

Cities watching Dallas now have a clearer picture of how local rules can survive an early-stage legal attackespecially

when framed as regulating, not banning, and when the record doesn’t establish that the entire regulated class is shut out.

2) It gives lenders a roadmap too (even if they don’t love it)

If a lender wants to win a preemption challenge, the majority’s reasoning suggests it may need more than “our model breaks.”

It may need evidence showing the ordinance practically makes the business inoperable across competitorsor that the

state has clearly occupied the field or expressly preempted local action.

3) Consumers may see fewer rollovers and more structured payoff

The ordinance’s paydown rules and renewal limits are designed to reduce the “treadmill” effect where borrowers keep paying

fees while principal stays stubbornly alive. Whether consumers experience that as relief, reduced access to credit, or a

mix of both often depends on the borrower’s situation and what alternatives exist in the market.

A practical, non-legal-advice checklist for Dallas compliance

If you operate (or advise) a covered business in Dallas, the operational questions are as important as the courtroom ones.

This is not legal advicejust a practical checklist of what businesses typically need to map:

- Confirm whether each product falls under CSO rules, CAB rules, or both.

- Identify which transactions trigger the four-payment / 25% reduction structure.

- Build an underwriting workflow for verifying income documentation where required.

- For products subject to fee caps, model pricing under a daily cap (and document assumptions).

- Create training scripts and front-counter materials for required posters and counseling referrals.

- Audit renewal/refinance logic in the servicing system to ensure limits are enforced automatically.

- Maintain records to demonstrate compliance if the city requests proof.

FAQ: quick answers people search for

Did the Fifth Circuit say Dallas can regulate payday lending however it wants?

No. The court affirmed denial of a preliminary injunction on this record, meaning the ordinance stays in effect while the

case continues. It did not declare that every possible local lending rule is always valid.

What was the key reason TitleMax didn’t get the injunction?

The Fifth Circuit concluded TitleMax did not show a sufficient likelihood of success on its claimsparticularly on state

preemption and due-course-of-law theoriesgiven how Texas treats home-rule authority and lending regulation.

Why does the “virtual prohibition” idea matter?

Because Texas law generally does not allow a city to do indirectly what it can’t do directly: ban a state-licensed or

state-regulated occupation by making it impossible to operate. The majority said TitleMax didn’t prove that across the

regulated market; the dissent said TitleMax’s evidence was stronger than the majority credited.

Bottom line: what to watch next

Even though headlines say “upheld,” this fight is more like a season finale that ends with “To be continued…”

-

Further litigation: because this was preliminary relief, later stages could sharpen the record on

operability, profitability, and market-wide impact. -

State legislative action: preemption landscapes can change if the Legislature expressly limits local

regulation in this area (or expands it). -

Local experimentation: other Texas cities may borrow Dallas’s structureor tweak itnow that they’ve

seen how the Fifth Circuit analyzed it.

Experiences related to the Fifth Circuit decision (real-world lessons from the “Dallas rules” era)

When a court decision keeps a local lending ordinance alive, the most immediate “experience” isn’t in the courthouseit’s

in the day-to-day friction of implementation. People on all sides tend to describe the same pattern: the first weeks feel

like a software update that arrives without a pause button. Store teams scramble to interpret what “four payments” means

for their product menu. Compliance teams build new checklists. Customers show up expecting last month’s terms and discover

that last month has left the building.

For frontline staff at lending locations, the practical experience often becomes a conversation about expectations. A

borrower might walk in thinking, “I just need a quick bridge until payday,” while the Dallas structure pushes the

transaction toward scheduled reduction. That shift can be confusing at firstespecially for customers who were accustomed

to renewals that felt like “one more small fee” rather than a firm payoff track. Staff often end up using plain-language

scripts: “Each payment must reduce what you owe, not just keep the account open.” That’s not marketing; it’s survival.

For borrowers, experiences vary. Some borrowers report that a forced paydown feels like a guardrail: it reduces the sense

that they’re trapped in a cycle of fees. Others feel it as a constraint: “If I can’t renew the way I used to, I may not be

able to borrow at all.” The lived experience depends on what alternatives existcredit unions, employer-based advances,

family support, community programs, or none of the above. The Dallas ordinance’s counseling-referral components reflect an

attempt to connect borrowers with nonprofit resources, but in practice those resources may be unevenly known, unevenly

available, or simply not fast enough for an emergency bill.

For the businesses, one of the most common “experience stories” is the pricing model meeting a hard wall. When a fee cap

is expressed in daily terms (like 0.1% per day), it forces a lender to re-run the math that used to be buried in product

design. Operations teams often describe a moment of clarity that’s part spreadsheet, part existential crisis: “If we can’t

price this above X, we either change the product, change the borrower profile, or change where we operate.” Even if a

business remains open, it may shift away from the products most impacted by the cap, focusing instead on transactions that

are structured differently, supported by collateral, or otherwise less constrained.

City regulators and code-compliance staff often describe their own practical experience: enforcement is only as strong as

the ability to prove noncompliance. That’s why ordinances like Dallas’s tend to include documentation requirements,

posting requirements, and clear numeric thresholds. It’s easier to enforce “show me the income verification you used” and

“show me the schedule with meaningful paydown” than to litigate whether a fee is “too high” in the abstract. On-the-ground

enforcement experiences also shape how cities adjust guidance and FAQsbecause the first wave of confusion tends to produce

the same questions again and again.

Finally, for lawyers and policy folks, the experience is about evidence. The Fifth Circuit’s majority and dissent read the

same general situation differently: one side saw a city regulating a business model; the other saw credible evidence that a

specific cap functioned like a practical prohibition for a particular product line. The lesson people take from that split

is blunt: if you want courts to treat an ordinance as a “virtual prohibition,” you need a record that persuades not only

that your business struggles, but that the regulated class cannot realistically operate under the rulesor that the

state has clearly displaced local authority. In other words, future fights won’t be won by vibes. They’ll be won by facts,

math, and the kind of documentation that makes everyone wish they’d paid more attention in Accounting 101.

Conclusion

The Fifth Circuit’s decision to leave Dallas’s lending ordinance in place is a major win for the city at the preliminary

injunction stageand a cautionary tale for challengers who hope to stop local consumer-lending rules quickly. The ruling

underscores how Texas home-rule authority, state preemption doctrine, and the long history of lending regulation interact.

For borrowers, it’s about paydown and fewer repeat renewals. For businesses, it’s about redesigning products to match

stricter repayment and fee constraints. And for everyone else watching from the sidelines, it’s proof that in Texas,

“local regulation” can still have real biteespecially when it’s framed as rules of the road rather than a road closure.