Table of Contents >> Show >> Hide

- The Prediction Obsession Heading Into 2023

- Ben Carlson’s “One More Prediction” in Plain English

- What 2023 Actually Taught Investors

- Building Your Own “Common Sense” Forecast

- Practical Ways to Invest With Common Sense

- One More Prediction You Can Actually Use

- Experience: Living Through a Year of “Common Sense” Investing

Every December, Wall Street releases glossy PDFs full of charts, acronyms, and very confident faces telling us exactly what will happen next year.

By March, at least half of those forecasts are quietly dying in someone’s inbox.

Heading into 2023, the script felt familiar: inflation was too high, interest rates were rising, and economists were arguing over which flavor of pain we’d get –

“mild recession,” “soft landing,” or “no landing at all.”

If you followed the headlines, you could be forgiven for thinking the only rational move was to bury your cash in the backyard.

Against that noisy backdrop, Ben Carlson at A Wealth of Common Sense offered a refreshingly boring forecast in his post

“One More Prediction For 2023.” Instead of predicting GDP growth to the second decimal or the exact level of the S&P 500,

he made one simple call: the stock market would experience a correction in 2023.

At first glance, that sounds like predicting that summer will be hot. But that’s the point. Carlson’s “one more prediction” isn’t about clairvoyance;

it’s about common sense: focus on the risks you can be sure will show up, not on the exact path prices will take along the way.

The Prediction Obsession Heading Into 2023

Before we unpack Carlson’s idea, it’s worth remembering the emotional climate in early 2023.

After a brutal 2022 for both stocks and bonds, consensus expectations clustered around some combination of weaker growth, sticky inflation,

and a decent chance of recession.

What Wall Street Said

Many macro outlooks for 2023 leaned toward:

- Slower global growth and possible recession, especially in developed economies.

- Inflation coming down from painful 2022 levels, but remaining above central bank targets.

- Central banks keeping rates elevated and potentially overtightening.

- Modest or flat stock market returns, with lots of volatility along the way.

In other words: “Things will probably be uncomfortable, and we’ll likely be wrong, but here’s 60 pages of charts anyway.”

What Actually Happened

The economic reality was messier and kinder than many feared. The U.S. avoided a classic recession while inflation cooled significantly from 2022 peaks,

and the much-discussed “soft landing” suddenly looked plausible instead of delusional.

Meanwhile, the S&P 500 delivered a powerful rebound, posting a total return of roughly 26% in 2023 after its big loss in 2022.

If you built your entire plan around doom, you missed one of the better years for stocks in recent history.

But if you built your plan around common sense expectations – including the inevitability of corrections – you had a much better shot at staying the course.

Ben Carlson’s “One More Prediction” in Plain English

In his 2023 post, Carlson starts by joking about what his outlook would sound like if he played the Wall Street strategist game:

a correction early in the year, mild recession later, and a rally into year-end. It sounds smart, but he’s the first to admit he doesn’t actually believe it.

Then he pivots to the heart of the matter: the only forecast he’s willing to put his name on is that

the stock market will experience a correction in 2023. Not because he has special insight into Fed meetings or earnings reports,

but because the data say that markets always correct.

Corrections Are a Feature, Not a Bug

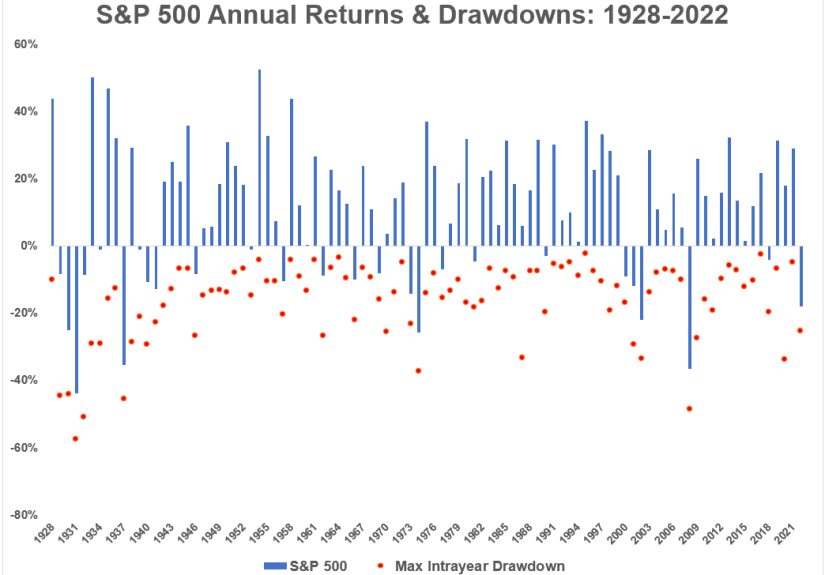

Carlson leans on long-term market history to make his case:

- Over the last century, only about 5% of trading days have been new all-time highs for U.S. stocks – the rest of the time,

you’re in some kind of drawdown from a peak. - Roughly two-thirds of calendar years see a double-digit intra-year drawdown, even in years that finish positive.

- About 94% of years experience at least a 5% pullback from their intra-year highs.

Translation: if you’re surprised by a correction, the problem isn’t the market – it’s your expectations.

Risk Is Easier to Predict Than Returns

Carlson’s deeper point is philosophical: risk is more predictable than returns.

We have no idea what the S&P 500 will return in any given year. But we can say with high confidence that there will be volatility,

drawdowns, scary headlines, and at least one moment when you question all your life choices as an investor.

This is consistent with decades of market research: long-term returns have been surprisingly stable – roughly 9–10% annualized for U.S. stocks –

but the path to those returns has been a roller coaster, with big crashes, sharp rebounds, and plenty of “what on earth is happening?” in between.

Common sense investing doesn’t pretend to remove the roller coaster. It simply says: “The ride is bumpy. Buckle up accordingly.”

What 2023 Actually Taught Investors

In hindsight, 2023 is almost a case study in Carlson’s thesis.

After a rough 2022, investors were on edge. Yet by the end of 2023, U.S. stocks had delivered that ~26% total return,

powered by a rebound in large-cap tech and growing confidence that inflation was coming under control.

Along the way, markets still experienced pullbacks, sector rotations, and plenty of “this is it, the rally is over” moments.

The lesson? The correction was basically guaranteed; the strong full-year return was not.

If you waited for the “perfect” entry or tried to trade every twist and turn, you were fighting the odds.

If you accepted that volatility was part of the package and stayed invested, you rode the recovery.

Building Your Own “Common Sense” Forecast

So how do you put this into practice without a Bloomberg terminal, a PhD, or a 60-page outlook deck?

1. Predict the Behavior of Risk, Not Precise Returns

A practical “common sense” forecast for any year might look like this:

- Stocks will probably be volatile.

- There will likely be at least one correction of 5–10% or more.

- Headlines will regularly suggest this time is different.

- Over a long horizon, diversified stock portfolios are still likely to outpace cash and inflation.

None of that sounds sexy. But it’s far more actionable than “the S&P 500 will close at 4,635.27 on December 31.”

2. Anchor on Probabilities, Not Certainties

Carlson emphasizes thinking in terms of probabilities and ranges.

Maybe you can imagine a few plausible scenarios for the year: a soft landing, a mild recession, a stronger-than-expected boom.

Instead of betting everything on one storyboard, you build a portfolio that can live with several outcomes.

That’s how many institutional investors and endowments think: they don’t try to nail the exact path; they try to avoid outcomes that would break the plan.

3. Focus on What You Can Control

You can’t control the Fed, inflation, or geopolitical shocks. You can control:

- Your savings rate.

- Your asset allocation (mix of stocks, bonds, cash, etc.).

- Your diversification across sectors, countries, and asset classes.

- Your behavior during drawdowns.

- Your investment costs and taxes.

Research on “common sense investing” – from the Bogleheads community to mainstream personal finance guidance –

consistently shows that low costs, broad diversification, and patience matter far more than forecasting genius.

Practical Ways to Invest With Common Sense

Use Corrections as a Design Feature

If Carlson is right and corrections are a near-annual event, then they shouldn’t be treated as rare disasters. They should be part of the design.

- Build in cash buffers if you’re retired or drawing from your portfolio, so you’re not forced to sell stocks at the bottom.

- Pre-commit to rebalancing – selling a bit of what’s gone up and buying what’s gone down – instead of improvising when emotions are high.

- Make volatility a friend if you’re still saving: automatic monthly contributions turn selloffs into buying opportunities.

Short-Term Uncertainty, Long-Term Odds

Historical data show that the odds of losing money in stocks over a single year are meaningful but shrink dramatically over 10- or 20-year horizons.

That doesn’t mean stocks are “safe” in the way a savings account is, but it does mean that time is the most underrated risk-management tool most investors have.

A “Wealth of Common Sense” style approach says: accept that the next 12 months are noisy and unknowable,

but build your plan around the next 10–30 years, where the probabilities are much friendlier.

The Emotional Side: Less Staring, More Living

Carlson often points out that the more frequently you check your portfolio, the worse you feel, even if long-term results are fine.

That’s classic behavioral finance: short-term losses hurt more than gains feel good, so constant monitoring can amplify fear and trigger bad decisions.

Common sense move: automate your investing, set reasonable guardrails, and then give yourself permission to look less.

Your mental health and your portfolio will likely thank you.

One More Prediction You Can Actually Use

If we boil Carlson’s “one more prediction for 2023” down to its core, we get something surprisingly humble:

there will be corrections; plan for them instead of pretending they won’t happen.

That mindset travels well. It works in 2023, 2024, 2030 – whenever. While Wall Street churns out increasingly precise but fragile forecasts,

common sense investing focuses on robust principles:

- The future is uncertain and often surprising.

- Volatility is normal, not a glitch.

- Risk is easier to anticipate than exact returns.

- Patience, diversification, and discipline are durable advantages.

You don’t need to know the exact path of the S&P 500 next year. You just need a plan that can handle the fact that it will rarely move in a straight line.

Experience: Living Through a Year of “Common Sense” Investing

To see how this plays out in real life, imagine two investors, Alex and Jordan, heading into 2023.

Alex is a prediction junkie. In December 2022, he devours bank outlooks, macro podcasts, and Twitter threads.

Most of what he sees calls for a tough year: inflation still elevated, the Fed still tightening, recession odds high.

Convinced that “the smart money” is bearish, Alex moves a big chunk of his portfolio into cash and short-term bonds, promising himself he’ll buy back into stocks “after things settle down.”

Jordan takes a different approach. She reads some of the same reports but also stumbles onto Ben Carlson’s

One More Prediction For 2023 post. The idea that a correction is almost guaranteed doesn’t scare her – it helps her reframe what “normal” looks like.

Instead of obsessing over whether 2023 will be a recession year or a soft landing, she writes down her own common sense forecast:

- There will likely be at least one scary pullback in stocks.

- Headlines will scream that “this time is different.”

- Over the next 15+ years, staying invested in a diversified portfolio gives her a good shot at reaching her goals.

Jordan reviews her plan. She’s 35, investing for retirement, with plenty of time ahead.

She decides to keep her stock-heavy allocation, add a modest cash buffer for peace of mind,

and set up automatic monthly contributions to her index funds. She also writes a simple rule for herself:

“If the market falls 10% or more, I’ll keep buying on schedule. No panic selling.”

Fast forward into 2023. Volatility shows up. Certain sectors fall sharply while others rip higher.

Commentators argue daily about whether a recession is coming or already here. At several points,

Alex feels vindicated – “See, this is why I got out” – but he never quite finds the perfect re-entry moment.

Every rally feels like a trap; every dip feels like the start of something worse.

Jordan, meanwhile, mostly ignores the day-to-day noise. Her automatic contributions keep buying through the bumps.

When markets wobble, she reminds herself of Carlson’s point: corrections are the one thing you should expect.

Instead of treating them as failures of the system, she sees them as the admission price for long-term returns.

By the end of 2023, the strong rebound in stocks has pushed her portfolio meaningfully higher.

She didn’t time the bottom, but she didn’t need to. The combination of staying invested, continuing to buy, and not panicking did the heavy lifting.

Alex eventually buys back in – but only after a big chunk of the year’s gains is already behind him.

He isn’t ruined, but he’s frustrated. He did more work, spent more time worrying, and ended up with less to show for it than Jordan,

who spent the year mostly living her life instead of refreshing market apps.

That’s what “a wealth of common sense” looks like in practice. It’s not about predicting precise numbers or calling turning points before everyone else.

It’s about:

- Accepting that volatility and corrections are built into the system.

- Designing a portfolio that matches your time horizon and risk tolerance.

- Automating good behavior so you don’t have to be perfectly rational in real time.

- Spending more energy on your actual life than on guessing the next move in the S&P 500.

If you carry one lesson from Carlson’s 2023 prediction into the future, let it be this:

you don’t need more forecasts; you need better expectations. Expect corrections. Expect surprises.

Expect your future self to be tempted to overreact. Then build a plan strong enough – and simple enough – to handle all of that.

That’s not just one more prediction. That’s a durable strategy.