Table of Contents >> Show >> Hide

- Quick Answer: Medicare’s Vaccine Coverage Is Split Between Part B and Part D

- Part B Vaccine Coverage: What’s Covered, How Often, and What You Pay

- Part D Vaccine Coverage: What’s Included and Why It’s Often $0 Now

- Original Medicare vs. Medicare Advantage: Does Vaccine Coverage Change?

- Where to Get Vaccines (and How to Avoid Surprise Bills)

- Which Vaccines Does Medicare Usually NOT Cover?

- FAQ: Fast, Practical Answers

- Conclusion: Medicare Covers a LotWhen You Know Where to Look

- Real-World Experiences: What Medicare Vaccine Coverage Looks Like in Everyday Life (About )

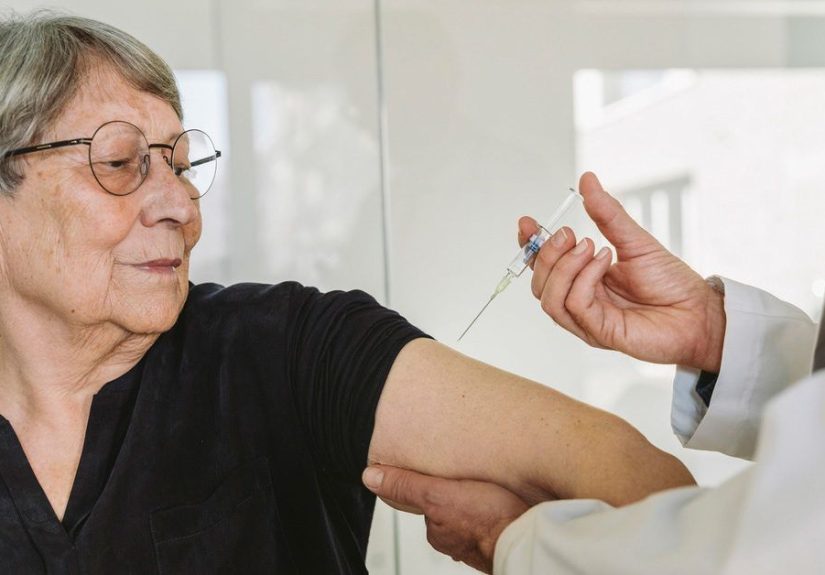

Vaccines are a little like smoke detectors: you don’t think about them until you really, really wish you had. The good news? Medicare covers a surprising number of vaccinesoften with $0 out of pocketbut the coverage depends on which part of Medicare you’re using and why you’re getting the shot.

This guide breaks it down in plain English (with minimal insurance-speak and maximal helpfulness), including: which vaccines fall under Part B vs. Part D, what “free” actually means in real life, and how to avoid the dreaded “Wait… why did I get billed?” moment.

Quick Answer: Medicare’s Vaccine Coverage Is Split Between Part B and Part D

Medicare Part B vaccines (medical coverage)

Think of Part B as the “preventive essentials + special situations” bucket. In general, Part B covers:

- Flu (influenza) vaccine (typically once per flu season)

- Pneumococcal vaccines (to help prevent certain kinds of pneumonia and invasive disease)

- COVID-19 vaccines

- Hepatitis B vaccine for people at medium or high risk

- Vaccines related to injury or direct exposure (classic examples: tetanus after a wound, rabies after an animal bite)

Many Part B vaccines cost you nothing as long as your provider accepts assignment.

Medicare Part D vaccines (drug coverage)

Part D is the “everything else that’s commercially available and preventive” bucket. If it’s a vaccine that helps prevent illness and it isn’t one of the Part B vaccines above, it usually lands under Part D. Common Part D vaccines include:

- Shingles (zoster)

- RSV (respiratory syncytial virus) for eligible adults

- Tdap (tetanus, diphtheria, pertussis) and routine Td/Tdap boosters

- MMR (measles, mumps, rubella) for adults who need it

- Varicella (chickenpox) for adults who aren’t immune

- Other adult vaccines recommended for certain ages, health conditions, lifestyles, jobs, or risk factors

Here’s the headline-making change that simplified a lot of wallets: Since January 1, 2023, adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP) that are covered under Part D generally have $0 cost sharing. Translation: no deductible, no copay, no coinsurance for those recommended Part D vaccines.

Part B Vaccine Coverage: What’s Covered, How Often, and What You Pay

Flu shots (influenza vaccine)

Medicare Part B covers the seasonal flu shot. In most cases, you can get it once per flu season. If you’re thinking, “So… I can get my flu shot annually and then go brag about it at brunch?” Correct.

Cost tip: You typically pay $0 if the provider accepts assignment. If you get your flu shot at a pharmacy, it’s still generally billed through your Medicare coveragejust bring your Medicare card (and your best “I came prepared” face).

Pneumococcal vaccines (pneumonia shots)

Medicare Part B covers pneumococcal vaccines. The exact schedule depends on your vaccination history and current clinical guidelines (your clinician will pick the appropriate product and timing based on CDC guidance and your health status).

Cost tip: Typically $0 if your provider accepts assignment.

COVID-19 vaccines

Medicare covers COVID-19 vaccines under Part B, and beneficiaries generally pay nothing when the provider accepts assignment. If you’re in a Medicare Advantage plan, you’ll usually need to use an in-network provider to keep it at $0.

Pro move: When booking at a pharmacy, ask: “Do you bill Medicare Part B for the COVID vaccine, and am I $0 with my plan?” It’s a 12-second question that can save a 12-minute phone call later.

Hepatitis B shots (for people at medium or high risk)

Medicare Part B covers the Hepatitis B vaccine for people who meet eligibility criteria, generally tied to risk level. That could include people with certain medical conditions, exposures, or living situations that raise risk.

Cost tip: You typically pay $0 if your provider accepts assignment.

Example: If your doctor flags you as higher risk (for instance, due to medical history or household exposure), they may recommend the Hep B series and bill it under Part B as a preventive service.

Vaccines after an injury or direct exposure (the “this is not a routine booster” category)

Medicare Part B can cover certain vaccines when they’re directly related to treating an injury or direct exposurethink: tetanus after a puncture wound or rabies after an animal bite. This is different from getting a routine booster “just because it’s been 10 years.”

Why it matters: The same vaccine can be Part B or Part D depending on context. A tetanus shot because you stepped on a nail? Often Part B. A routine tetanus booster at your annual checkup? Typically Part D.

Part D Vaccine Coverage: What’s Included and Why It’s Often $0 Now

Common Part D vaccines (the ones people actually ask about)

If your question is “Does Medicare cover that vaccine?” and “that” means shingles, RSV, or Tdap, you’re usually looking at Part D. These are among the most common Part D-covered vaccines for adults:

- Shingles (zoster): Covered under Part D and usually $0 with Part D for ACIP-recommended vaccination.

- RSV: Typically covered under Part D and often $0 when recommended.

- Tdap/Td: Routine boosters are generally Part D; injury-related tetanus may be Part B.

- MMR, varicella, and other adult vaccines when recommended based on age, health conditions, and risk factors.

What “$0 cost” really means (and the small print worth knowing)

Since 2023, Part D plans generally can’t apply deductibles or cost sharing for adult vaccines recommended by ACIP. That’s a big dealbecause before that change, people sometimes paid real money out of pocket for vaccines like shingles.

Still, practical hiccups can happen:

- Out-of-network vaccine providers: ACIP-recommended Part D vaccines are generally still $0 cost sharing, but you might be asked to pay an administration fee upfront and then get reimbursed by the plan.

- Newly approved vaccines: Sometimes a plan’s systems take time to update. If a vaccine isn’t showing as covered at the pharmacy, your prescriber or you may need to request coverage through the plan’s exception process.

- Non-ACIP-recommended vaccines: If a vaccine isn’t recommended by ACIP for your situation, a plan may charge copays/coinsurance.

If the vaccine isn’t on your plan’s formulary

Don’t panic. Medicare guidance and public health resources emphasize that even if a plan’s formulary doesn’t list every Part D vaccine, the plan must still provide access to Part D vaccines when appropriately prescribedsometimes via exceptions or specific billing processes. If a pharmacist tells you, “It’s not on the list,” the next sentence should be, “Okaywhat’s the process to bill it correctly or request coverage?”

Original Medicare vs. Medicare Advantage: Does Vaccine Coverage Change?

The vaccine categories (Part B vs. Part D) stay essentially the same, but the logistics can change:

- Original Medicare: You’ll use your red-white-and-blue Medicare card for Part B vaccines. For Part D vaccines, you’ll use your Part D plan info.

- Medicare Advantage (Part C): You generally use your plan card for Medicare-covered services. Plans may require in-network locations for the smoothest $0 experience, especially for Part B-covered vaccines like COVID-19.

Bottom line: Coverage is strong either way, but Medicare Advantage plans can add network rules that affect where you go.

Where to Get Vaccines (and How to Avoid Surprise Bills)

Choose the right place: pharmacy, doctor’s office, clinic, or health department

Most adults get vaccines at one of three places: a pharmacy, a primary care office, or a community clinic. Pharmacies are often the fastest option, but doctor’s offices can be best for vaccines tied to a specific medical risk discussion (like Hep B eligibility under Part B).

Bring the right card (yes, plural)

- Part B vaccines: Bring your Medicare card (or Medicare Advantage card if you’re in Part C).

- Part D vaccines: Bring your Part D card/info (or your Medicare Advantage plan card if it includes drug coverage).

Ask these five questions before you roll up your sleeve

- Which part of Medicare will you billPart B or Part D?

- Am I $0 out of pocket for this vaccine with my plan?

- Are you in-network for my plan? (Especially important for Medicare Advantage.)

- Will I pay anything today and get reimbursed later?

- Do you need a prescription from my doctor? (Some vaccines can be billed without one; others may require it depending on setting and state rules.)

Which Vaccines Does Medicare Usually NOT Cover?

Medicare coverage is excellent for many routine and recommended adult vaccines, but there are still cases where you might pay out of pocket:

- Vaccines that aren’t recommended for you (for example, if a vaccine isn’t ACIP-recommended for your age/risk group, your Part D plan may apply cost sharing).

- Vaccines you get “too frequently” compared with recommended schedules (coverage can depend on medical necessity and timing).

- Travel-related vaccines and travel clinic bundles can be tricky: some may be covered under Part D depending on the vaccine and your plan, while others may not be covered or may involve cost sharing. Always check with your Part D plan before an international tripbecause the only thing worse than traveler’s diarrhea is surprise billing.

FAQ: Fast, Practical Answers

Does Medicare cover the shingles vaccine?

Yes. The shingles vaccine is covered under Medicare Part D, and people with Part D usually pay nothing for ACIP-recommended vaccination.

Does Medicare cover the RSV vaccine?

Typically yesRSV vaccination for eligible adults is usually covered under Part D and often costs $0 when recommended. (Eligibility depends on age, health status, and current guidance.)

Does Medicare cover Tdap?

Routine Tdap (and routine Td/Tdap boosters) are generally covered under Part D. If the shot is needed due to an injury (like a puncture wound), it may be covered under Part B.

What if a pharmacy tries to charge me for a covered vaccine?

First, don’t assume the charge is correct (systems are not always as fast as policy changes). Ask which part they’re billing (B or D), confirm they have your correct insurance details, and ask whether it’s a network issue. If needed, call your plan and ask the pharmacy to reprocess the claim or walk through the plan’s coverage/exception steps.

Conclusion: Medicare Covers a LotWhen You Know Where to Look

Medicare vaccine coverage boils down to a simple map: Part B covers flu, pneumococcal, COVID-19, Hep B (for eligible risk groups), and certain injury/exposure vaccines. Part D generally covers most other adult vaccinesincluding shingles, RSV, and Tdapand ACIP-recommended Part D vaccines are commonly $0 out of pocket.

Your best strategy is to treat vaccines like a two-step dance: (1) confirm whether it’s Part B or Part D, and (2) confirm you’re using the right provider/network for your plan. Do that, and you’ll spend less time fighting paperwork and more time enjoying the fun part of being protected: living your life.

Real-World Experiences: What Medicare Vaccine Coverage Looks Like in Everyday Life (About )

The rules are one thing. Real life, as usual, adds plot twists. Here are a few “this totally happens” scenarios (shared as composites so you can recognize the patterns without anyone getting named and shamed).

1) The “Shingles Shot Victory Lap”

A 70-year-old decides it’s time for the shingles vaccine after a friend describes shingles as “a lightning storm, but on your skin.” They head to a local pharmacy with their Part D info, expecting a copay because “nothing is ever free.” Surprise: the pharmacist runs it through the Part D plan, and the out-of-pocket cost comes back as $0. The only real pain is the sore arm afterwardand honestly, that’s the preferred pain. The takeaway: Part D is usually where shingles lives, and many people now pay nothing when it’s recommended.

2) The Rusty Nail Plot Twist (Tetanus: Part B or Part D?)

Someone steps on a nail while doing heroic weekend DIY work. They go to urgent care and get a tetanus shot. This is the key detail: it’s tied to an injury. In that context, tetanus is often handled under Part B as part of treating the injury. But later, the same person tries to get a routine booster “just to be safe,” and the billing route changesnow it’s preventive and often runs under Part D. The takeaway: the same vaccine can be covered under different parts depending on why you need it.

3) The Hep B “Am I Eligible?” Conversation

Another common situation: a patient hears about hepatitis B vaccination and wants to be protected, but they’re unsure if Medicare will pay. Their clinician asks a few risk-based questionsmedical conditions, potential exposures, household risksand determines they meet criteria for medium or high risk. The vaccine is then covered under Part B, and the patient pays $0 when the provider accepts assignment. The takeaway: with Hep B, eligibility matters, and your doctor’s documentation can be the difference between smooth coverage and confusion.

4) The Medicare Advantage Network Detour

A Medicare Advantage member goes to a pharmacy across town for a COVID-19 shot because it’s near their favorite coffee shop. The pharmacy is out-of-network, and suddenly the “this should be $0” moment becomes a “why is there a charge?” moment. They switch to an in-network location and the cost goes back to $0. The takeaway: Medicare Advantage plans often add network rulescoverage is still there, but location can matter.

5) The Travel Clinic Reality Check

Someone planning an international trip schedules a travel clinic visit and expects Medicare to cover everything. The clinician recommends multiple travel-related vaccines and preventive medications. Some items may be covered under Part D depending on the vaccine and the plan, while others may notor may involve cost sharing. The traveler calls their Part D plan ahead of time, learns what’s covered, and avoids last-minute sticker shock. The takeaway: for travel vaccines, check with your Part D plan before you book the appointment.

If these scenarios have a moral, it’s this: Medicare coverage is often generous, but the smoothest experience happens when you confirm Part B vs. Part D, verify network rules (especially for Medicare Advantage), and ask billing questions before the needle shows up.