Table of Contents >> Show >> Hide

- When your portfolio drifts, your risk drifts

- Bitcoin’s “special skill” is volatilityplan accordingly

- Selling some is not surrenderit’s regret minimization

- There’s more money at stake now (and that changes everything)

- The unglamorous realities: taxes, custody, and platform risk

- What “selling some” does not mean

- A common-sense checklist for deciding whether to trim Bitcoin

- Conclusion: A plan beats a prophecy

- Experience Notes: of Real-World Lessons (Composite Examples)

Bitcoin has a talent for making everyone feel like a genius… right up until it doesn’t. One minute, your portfolio is strutting around like it just won

“Best Dressed,” and the next it’s wearing sweatpants, eating cereal for dinner, and asking you not to talk about the chart.

So let’s talk about something that sounds scandalous in crypto circles: selling some Bitcoin. Not rage-quitting. Not declaring “Bitcoin is dead”

(it has survived more funerals than a soap opera character). Just trimming a position because your portfolio has gotten louder than your plan.

The core idea is simple: when a volatile asset grows into an outsized chunk of your net worth, the smartest move can be to right-size it. That’s not a

betrayal. That’s portfolio management. And, honestly, it’s also sleep management.

When your portfolio drifts, your risk drifts

Most investors don’t wake up one day and decide, “I’d love to increase my risk today.” It just happens quietlybecause winners grow, and big winners grow

faster than your ability to stay calm.

Rebalancing: the boring superpower

Rebalancing is the practice of bringing your portfolio back toward a target allocationyour chosen mix of assets and risk. Schwab describes it as a

disciplined way to keep your intended risk level consistent over time, rather than letting the market decide it for you.

Vanguard makes a similar point: rebalancing is primarily about managing risk and emotion, not about trying to maximize returns or time the market.

This matters even more with Bitcoin, because it’s the kind of asset that can go from “small side position” to “largest personality in the room” in one

strong cycle. In Ben Carlson’s post on A Wealth of Common Sense, he describes trimming Bitcoin after it grew to roughly 10% of his portfolio,

aiming to bring it back down to a more comfortable level (around 5%).

Why 10% feels different than 2% (even if you love Bitcoin)

Let’s use a clean, non-magical example:

- You start with a $100,000 portfolio.

- Your plan says Bitcoin is a 5% slice ($5,000), with the rest in a diversified mix.

- Bitcoin triples while everything else is flat (not realistic, but convenient for math and emotional damage).

- Your Bitcoin becomes $15,000now ~13% of the portfolio.

Notice what happened: you didn’t choose to become a “13% Bitcoin investor.” The market chose it for you. And if Bitcoin has historically been capable of

massive drawdowns, your portfolio is now more exposed to those drawdowns than you intended.

Selling some Bitcoin in this situation isn’t a prediction about tomorrow. It’s a decision about your risk budget today.

Bitcoin’s “special skill” is volatilityplan accordingly

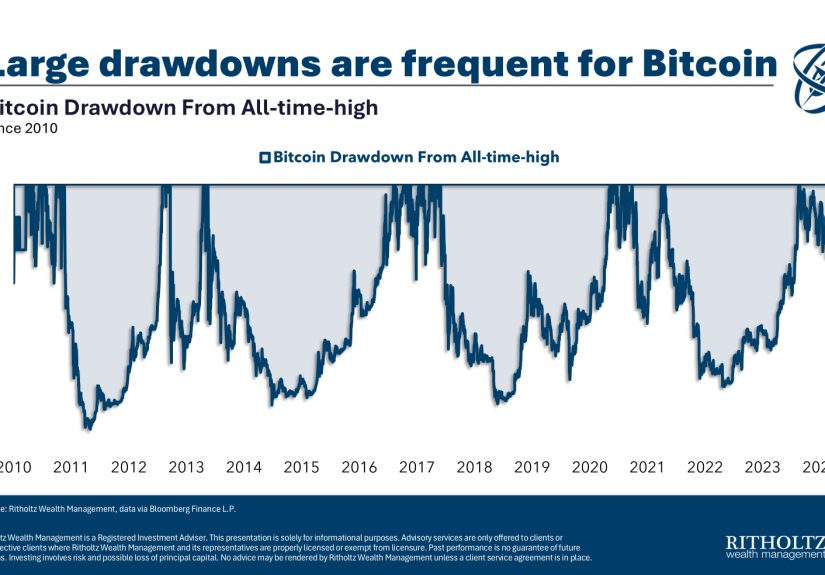

Bitcoin trades 24/7, globally, without corporate cash flows to anchor valuation the way stocks can be anchored by earnings and dividends. That structure

helps explain why it can experience stomach-churning swingsfast.

Regulators and investor-education groups regularly flag crypto’s volatility and downside risk. FINRA notes crypto assets can be “extremely volatile” and

that the risk of losing your entire investment can be significant.

The SEC’s investor education materials also warn that crypto-related investments can be exceptionally speculative and volatile, and that investors should

only risk money they can afford to lose entirely.

Volatility isn’t just mathit’s behavior

The hardest part of Bitcoin isn’t understanding the technology. The hardest part is staying rational when the price action is doing parkour.

A huge run-up creates a different kind of danger than a crash: it can quietly inflate your confidence. Then, when the inevitable pullback arrives, you

realize you weren’t holding “a little Bitcoin.” You were holding “enough Bitcoin to ruin your mood for a month.”

This is why rebalancing can be a practical way to “harvest” volatility without pretending you can predict peaks. It forces you to trim when something has

gotten too bigbefore it has the chance to become too painful.

Selling some is not surrenderit’s regret minimization

One of the most human reasons to trim Bitcoin is also the least spreadsheet-y: you’re trying to reduce future regret.

Carlson describes a “regret minimization” approachselling a portion so you won’t feel terrible if Bitcoin crashes again, while keeping exposure so you

won’t feel terrible if it keeps running.

The psychological math of “I’ll split the difference”

Here’s what regret minimization looks like in plain English:

- If I sell everything and it keeps soaring, I’ll feel like I abandoned the party five minutes before the cake arrived.

- If I sell nothing and it collapses, I’ll feel like I watched a slow-motion car crash and politely refused to touch the brakes.

- If I sell some, I accept that I’ll have a little regret either waybut not the maximum regret in one direction.

This is not about being “weak.” It’s about recognizing that investing is done by humans with nervous systemsnot robots with perfect discipline.

There’s more money at stake now (and that changes everything)

Another reason selling some Bitcoin starts to make sense over time: the position may have multiplied. When an asset goes up 5–6x from your cost basis,

it can go from “interesting” to “meaningful.”

Losing 50% on a small position is an unpleasant story. Losing 50% on a large position can materially change your goalshome down payment, emergency fund

cushion, retirement timeline, or the simple ability to remain a decent conversational partner.

This is where a “common-sense” approach shows up: you don’t have to hate Bitcoin to admit that your future self might prefer fewer heart-palpitations per

quarter.

The unglamorous realities: taxes, custody, and platform risk

If Bitcoin is the thrilling movie trailer, then taxes and custody are the fine print you click “agree” on without readinguntil the plot twist arrives.

Let’s not do that.

Taxes: selling can be a taxable event (U.S.)

In the United States, the IRS states that when you sell virtual currency, you generally recognize a capital gain or loss. Holding period matters: gains on

assets held more than a year can be treated differently than short-term gains.

Translation: trimming a position may come with a tax bill, and it’s smart to know that before you hit “confirm.” Even using crypto to pay for services or

exchanging it for other property can trigger gain/loss considerations.

Custody: “my crypto is on an exchange” isn’t the same as “my crypto is safe”

The SEC’s investor education bulletin explains that crypto “custody” is about how and where you store and access your crypto assetsand that wallets

generally store private keys or passcodes, not the assets themselves. Losing access to keys, or relying on a third party that fails, can mean losing

access to your crypto.

The SEC also warns that some platforms may lack protections investors are used to in traditional finance, and that in some failures customers may not be

able to withdraw assets as expected.

FINRA echoes this broader theme by highlighting risks around volatility, theft, scams, and the possibility that certain protections (like SIPA coverage)

may not apply.

Scams and “too good to be true” is basically crypto’s second language

The SEC has repeatedly warned about fraud and scams in crypto-related investments, including how easily hype and social proof can be weaponized.

The CFTC also issues customer advisories emphasizing that virtual currency markets can carry substantial risks and that “red flags” should be taken

seriously.

A practical implication for “selling some Bitcoin” is this: when you reduce position size, you reduce the damage a single bad actor, hack, or platform

failure can do to your life.

What “selling some” does not mean

Let’s clear the air:

- It doesn’t mean you’re calling the top. Rebalancing can happen at many points in a cycle.

- It doesn’t mean you think Bitcoin is worthless. You can believe in the thesis and still manage exposure.

- It doesn’t mean you’re out forever. Some investors trim on the way up and add on the way down as part of a risk framework.

In fact, treating Bitcoin like a position within a broader portfoliorather than a lifestyle identitycan be the most sustainable way to hold it.

A common-sense checklist for deciding whether to trim Bitcoin

This is not investment advice. It’s a set of sanity-check questions that help you think like a risk manager instead of a headline reader.

1) Has the position outgrown your original plan?

If Bitcoin is now a much larger percentage of your portfolio than you intended, you’re no longer following an allocationyou’re following momentum.

Rebalancing exists to correct that drift.

2) Would you buy it today at this size?

Imagine you currently held zero Bitcoin. Would you choose to allocate the same percentage of your net worth at today’s prices? If the answer is “absolutely

not,” that’s information worth respecting.

3) If it fell 50% from here, would your life change?

Crypto can move fast. If a large drop would force you to delay important goals or cause you to panic-sell at the worst moment, your position size may be

too large for your real-world risk tolerance.

4) Are you ignoring taxes and logistics?

The IRS is not impressed by “but it was an emotional decision.” If you’re selling, understand that gains/losses are part of the story, and records matter.

5) Are you relying on a custody setup you don’t fully understand?

If your entire exposure depends on a platform, password hygiene, or a recovery method you’ve never tested, reducing size might be a risk-reduction move

all by itself.

Conclusion: A plan beats a prophecy

The internet loves heroic narratives: “never sell,” “diamond hands,” “this time is different,” “laser eyes forever.” Those stories are entertaining, but

they’re not a portfolio policy.

A wealth-of-common-sense approach is less cinematic and more effective: decide what role Bitcoin plays in your portfolio, set a target allocation you can

live with, and rebalance when reality drifts too far from the plan. That’s not market timing. That’s risk timingmeaning you’re managing how much of your

future depends on an asset that can swing wildly.

If you’re under 18, keep it extra simple: focus on learning, building saving habits, and talking with a parent/guardian about any real investing decisions.

Many financial accounts have age requirements, and it’s never worth trying to “hack” adulthood with someone else’s credentials.

Bitcoin may keep rising. It may drop hard again. The one thing you can control is whether your portfolio is being run by your goalsor by your feelings.

Selling some Bitcoin is often just choosing goals.

Experience Notes: of Real-World Lessons (Composite Examples)

The most common “why I sold some Bitcoin” story doesn’t start with a bold prediction. It starts with an accidental transformation. One investor (we’ll call

her Maya) bought a small amount during a hype cycle because she didn’t want to feel left behind. It wasn’t a master planmore like a curiosity with a

receipt. Years later, after a few dramatic booms and brutal winters, she checked her accounts and realized Bitcoin had quietly become one of her largest

holdings. The moment wasn’t “I’m a genius.” The moment was “Wait… how did this become that big?”

Another investor (call him Jordan) had the opposite problem: he loved the idea of long-term holding so much that he never revisited his position sizing.

Every surge felt like proof that he was right. But when the price dropped sharply, he discovered something uncomfortablehe didn’t actually own “Bitcoin” so

much as he owned “a constant stream of adrenaline.” He was checking prices at breakfast, lunch, and 2:00 a.m. like Bitcoin was sending him texts.

Eventually he didn’t sell because he stopped believing; he sold because he started valuing sleep.

Then there’s the “tax surprise” experience. Someone trims a position after a big run, feels responsible, and then learns that “responsible” can still come

with paperwork. When you sell, you may owe capital gains tax, and holding period can matter.

A few people describe that moment as the financial equivalent of stepping on a LEGO: not life-ending, but memorable enough that you start planning ahead

next time.

Custody lessons show up the hard way, too. Plenty of people learn what the SEC means by “custody” only after they’ve had a scarelocked accounts, phishing

attempts, lost devices, or a platform pausing withdrawals.

Even if everything turns out fine, the experience has a way of changing your risk tolerance overnight. Suddenly, “I’m comfortable with 15% in Bitcoin”

becomes “I’m comfortable with 5% and a backup plan.”

Finally, there’s the regret-minimization crowd. They don’t want to be the person who sold everything right before another surgeand they don’t want to be

the person who rode an oversized position through another deep drawdown. So they trim a slice, keep a slice, and move on with their life. It’s not

perfect. It’s just human. And in investing, being humanwhile using rules to protect yourself from your most dramatic impulsesmight be the most common

sense of all.